Payables Integration with FA:

Payables houses all the transaction related to the money that needs to be paid. From the perspective of a functional, the invoice is used to register the transaction between purchaser & supplier.The invoice is the common entity between payables and other modules.The assets created from PA are created from capitalized project lines. You can track all expenses during construction and capitalize completed projects. You process construction-in-process (CIP) assets by adding,building and capitalizing them. CIP assets are not ready for use because

they are still being built and are non-depreciable. CIP assets can only be

added to Corporate books.

Integration with FA is done through Mass Addition

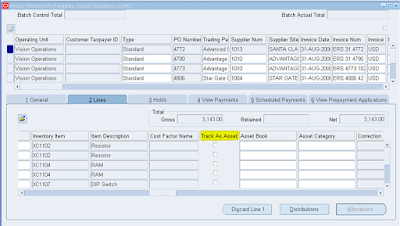

Create Mass Addition Program transfers the invoice distributions to Assets (FA) , when the option Track as Asset is enabled at invoice line level. Below screenshot shows the option to be checked if the invoice line needs to be tracked as asset.

Flow in Mass Addition:

Asset validation API is used for validating the invoice distribution lines before being loaded into

FA_MASS_ADDITIONS_GT table.

1. FA_MASS_ADDITIONS_GT populates all the records which are moved from AP to FA, data from AP_INVOICE_DISTRIBUTIONS_ALL & AP_SELF_ASSESSED_TAX_DISTRIBUTIONS are loaded when the below conditions are met:

assets_addition_flag='U'

assets_tracking_flag='Y'

once loaded into FA_MASS_ADDITIONS_GT are loaded the line_status is set to 'NEW'

2. Validation is done for the data loaded & the line_status is updated to 'PROCESSED' or 'REJECTED' processed lines are further inserted into FA_MASS_ADDITIONS for processing.

Possible reasons

line_status REJECTED:

- a child line in NEW status whose only matching parents are in the DELETE queue in FA_MASS_ADDITIONS;

if book_type_code is null

- a parent line with natural account derived from PAYABLES_CODE_COMBINATION_ID not matching asset clearing account for

a category of a book being processed or none of asset clearing accounts of any book if book is null

- a child line with rejected parent

line_status PROCESSED:

LINE_STATUS is set to VALID and at the end of FA code to PROCESSED

- a parent ITEM / ACCRUAL line with natural account derived from PAYABLES_CODE_COMBINATION_ID matching asset

clearing account for a category of a book being processed; if the book_type_code is NULL then the code will look

for a book with matching clearing account in category setup .

- a child line of a VALID parent in FA_MASS_ADDITIONS_GT

- a child line of a parent in FA_MASS_ADDITIONS

- a child line of a parent already posted to FA in previous run

Execution Parameters :

2 mandatory parameters needed for Mass Addition Create Program is

1. Asset book type code

2. Account Date

AP will transfer to FA all the distribution lines with an accounting date lower than the Accounting Date parameter,

which also belongs to the specified FA book parameter.

Prepare Mass Additions :

Once the data resides in FA_MASS_ADDITIONS, you must go into the Prepare Mass Additions form in Oracle Assets to enter additional information to each line in preparation for it to become an asset. You can do the following in the Prepare Mass Additions form:

- Enter additional source, descriptive and depreciation information.

- Assign the mass addition to one or more distributions, or change existing distributions in the Assignments window.

- Adjust the cost of a mass addition

- Merge a mass addition into another mass addition.

- Split a multiple-unit mass addition into several single-unit mass additions.

- Add mass addition lines to existing assets such as a cost adjustment.

After adding and/or updating your information, you then assign a mass addition queue to specify whether it is ready for posting. Only mass addition lines in the POST or COST ADJUSTMENT queue can be posted.

Post Mass Additions:

The posting process creates assets from mass addition lines in the POST queue using the data you entered. It also adds mass additions in the COST ADJUSTMENT queue to existing assets. You can run this program as often as you want during a period.